Seven & I Holdings (TYO:3382) Stock Analysis

Is the World's Largest Convenience Store Worth Owning?

Please note: This article is for informational purposes only and is not intended as investment advice. The mention of specific stocks is not a recommendation to buy or sell any securities.

At a Glance

Ticker Symbol: 3382 (Seven & I Holdings)

Current Stock Value: ¥2,158

Intrinsic Value (Reuter Thompson’s Starmine model): ¥1,815.17

P/E Ratio: 24.65x

Dividend Yield: 1.68%

Market Cap: ¥5.72 Trillion

Debt/Equity Ratio: 1.13x

Return on Equity (ROE): +8.70%

One of my first stock analyses on this newsletter dived into Seven & I Holdings, the powerhouse behind the ubiquitous 7-Eleven convenience stores. Since that initial look, the landscape has shifted considerably—not just for Seven & I Holdings but in the broader retail and convenience sector. On top of that, I've sharpened my skills and deepened my understanding of what makes a stock tick.

Given all these changes and my enhanced analytical acumen, I've decided it's high time to take another deep dive into Seven & I Holdings. Is it still the retail juggernaut we remember, or have shifts in consumer behavior and market dynamics changed the game? For a bit of nostalgia or a refresher, you can check out my first analysis here:

Table of Content

Company Overview & Executive Summary

Overview of Seven & I Holdings, its main operations, and financial health.

Segments

Breakdown and performance analysis of Seven & I's business segments.

SWOT Analysis

Strengths, weaknesses, opportunities, and threats facing Seven & I Holdings.

Key Competitors

Comparison with key competitors in the retail sector.

Intrinsic Value

I am using Thomson Reuters' StarMine model to estimate the stock’s intrinsic value.

Key Metrics

Important financial and operational metrics for Seven & I Holdings.

KonichiValue Score

A Buy, Hold or Sell recommendation is given, including a devil's advocate perspective.

1. Company Overview

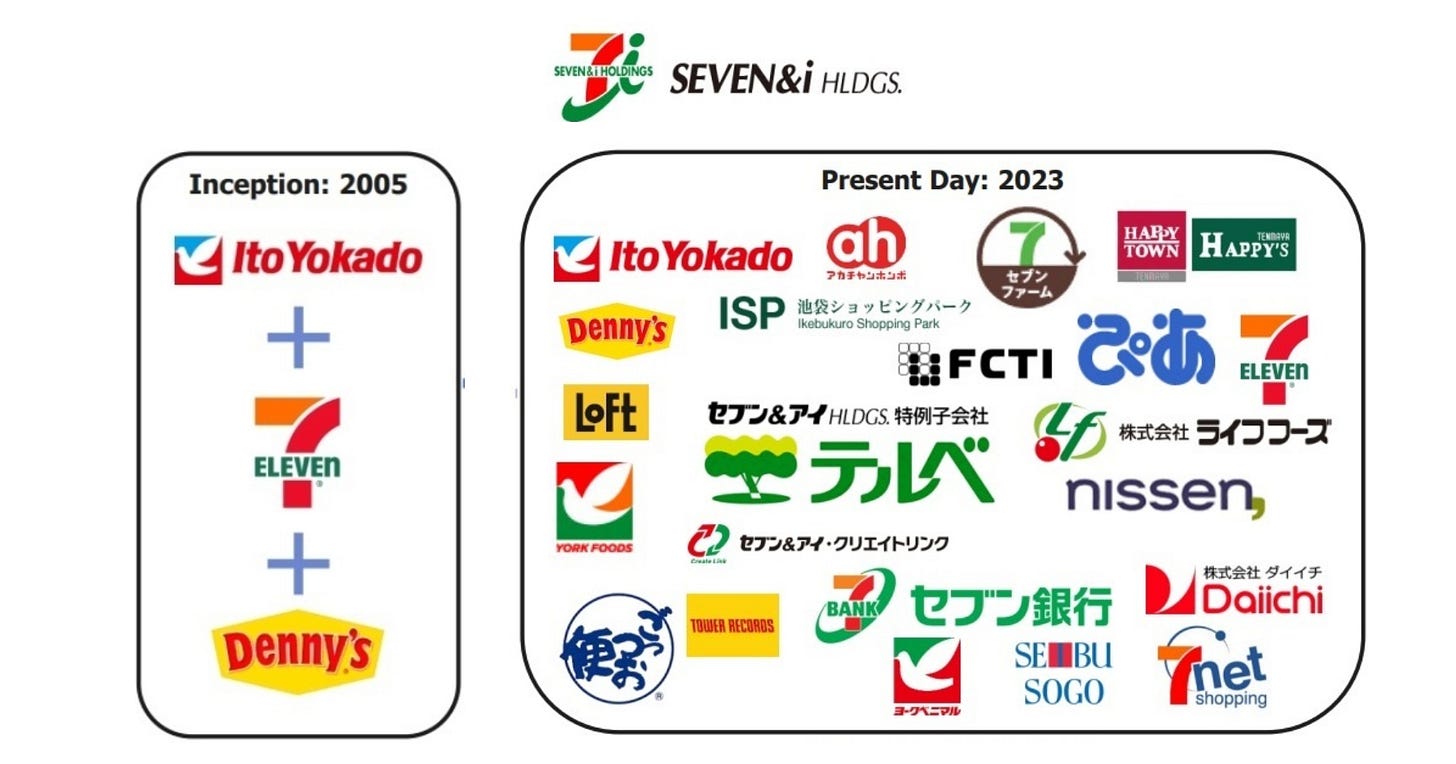

Meet Seven & I Holdings - the titan behind the snack fortress we know as 7-Eleven, which, by the way, is just the tip of the iceberg. These guys are everywhere - from your quick grab-and-go marts to supermarkets like Ito-Yokado, not to mention a bunch of department stores and even e-commerce. They're the kings of convenience, offering everything from munchies and threads to banking services. Talk about a one-stop shop, right?

Under the helm of CEO Ryuichi Isaka, they're not just sitting pretty on their convenience store throne; they're on the move. Becoming even more focused on their competitive advantage in the convenience store segment by snatching up the gas stations and convenience store giant Speedway in the US for $950.

The company's journey hasn't been without its hurdles, notably its significant debt load. In response, Seven & I has taken decisive steps to streamline operations and improve financial health. These include the divestiture of non-core assets, like the planned sale of the Sogo & Seibu department stores, which is part of a broader effort to reduce liabilities and concentrate resources on areas with the strongest return on investment. Additionally, operational efficiencies, such as the closure of underperforming supermarkets, are being implemented to cut costs and bolster the bottom line.

The recent period has been marked by significant strategic shifts for Seven & I, including global expansion efforts, notably in the US and Vietnam, and strategic divestitures like the sale of the Sogo & Seibu chains. These actions are designed to streamline operations and concentrate on segments with high growth potential, but is it enough?

2. Segments

Seven & I operates through multiple segments, each contributing significantly to its overall financial health and strategic direction. Let’s delve into each segment to understand its size, trend, and implications:

Keep reading with a 7-day free trial

Subscribe to KonichiValue Japan to keep reading this post and get 7 days of free access to the full post archives.

![[Stock-Analysis] The Kings of Convenience: 7-Eleven](https://substackcdn.com/image/fetch/$s_!Whv_!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fbucketeer-e05bbc84-baa3-437e-9518-adb32be77984.s3.amazonaws.com%2Fpublic%2Fimages%2F98376ef8-b79e-4d6a-b667-fa118759ee99_800x400.png)