For the TLDR on if ITOCHU is a stock you should buy, skip to 16:54.

For people looking at the podcast show notes, click HERE to go to the article.

TL;DR

ITOCHU's financial condition and free cash flow is good, and its business performance is showing long-term growth. In addition, The company’s dividends are increasing yearly, and the dividend yield is approximately 3%.

On the other hand, ITOCHU is arguably the most popular trading company stock, so its stock price is expensive compared to its peers. I think this is justified as it has performed better than its peers historically. However, if the company’s growth cannot be maintained, the price premium may be corrected and the stock price may fall.

All in all, I believe ITOCHU strong historical performance and current investments show that the stock still has room to grow long term. Hence, I believe this stock is the best stock among Japanese trading companies, and a buy on its current price!

What is ITOCHU, and Why is it so Interesting?

ITOCHU is a trading company with the second largest revenue of all companies in Japan!

Simply put, Japanese trading companies are massive conglomerates that own companies from basically every major industry and connect them to hopefully create synergies.

In general, these trading companies have been valued less on the stock market than the sum of their parts because they’re seen as old relics with bloated balance sheets and slow moving management.

However, in August 2020, Warren Buffett and his investment company Berkshire Hathaway bought roughly a 5% stakes in all big Japanese trading companies, Itochu (8001.Japan), Marubeni (8002.Japan), Mitsubishi (8058.Japan), Mitsui & Co. (8031.Japan), and Sumitomo (8053.Japan), the world suddenly opened their eyes to this forgotten segment.

ITOCHU is steadily growing in business performance and has a dividend yield of about 3% , making it suitable for high-dividend stock investment.

On top of that, the company has consistently improved its bottom line with an average revenue growth of 11.9% and an earnings growth of 16.9% over the past 7 years. On top of that, it is still trading at a Price to Earnings ratio (P/E) of 8.2!

In this article, I want to answer these questions:

How is ITOCHU's business performance and finance?"

Is ITOCHU’s stock price cheap or expensive?"

My Six Investment Criteria

To find out if ITOCHU is a good investment, I have the following six criteria:

Is the business growing?

Is the profit margin high?

Is the cash flow abundant?

Is the finances sound?

Is the stock price cheap?

Does the company have good attitude towards its shareholders?

1. ITOCHU's Business performance over the long-term is good

The first criterion is if the business is growing.

The long-term results (Revenue and Profits for the year) of ITOCHU since 2013 are as follows (cited by Borsdata) *NOTE: ITOCHU has a broken financial year where Q4 in a year ends in March.

ITOCHU's revenue is spotty in 2013 and 2019 due to changes in accounting standards and the conversion of other companies into consolidated subsidiaries. Actual revenue has not changed abruptly.

Since it is difficult to see changes in business performance when looking at sales, it is better to look at continuous ordinary income.

ITOCHU's profits have continued to increase since 2013, and reached the highest profits in 2019 due to making FamilyMart a consolidated subsidiary.

Ordinary income increased slightly in the fiscal year ended March 2020, when the new corona problem began.

Compared to before the Lehman Shock in 2008, ITOCHU's ordinary income has more than doubled, and ITOCHU's business performance has grown over the long term.

ITOCHU's business performance is relatively stable because the ratio of resource-related businesses is lower than its competitors.

In general, trading companies have a large proportion of resource-related businesses such as crude oil and metals. As a result, the performance of trading companies is easily affected by resource prices, and during the 2015-2016 period when resource prices were sluggish, the performance of other companies in the same industry, such as Mitsubishi Corporation and Mitsui & Co., declined sharply.

However, ITOCHU’s energy segment only accounts for 10% of total revenue (compared to >20% for Mitsubishi and Mitsui & Co). Hence, ITOCHU's business performance is not as affected by resource prices, and it is a relatively stable stock compared to its peers.

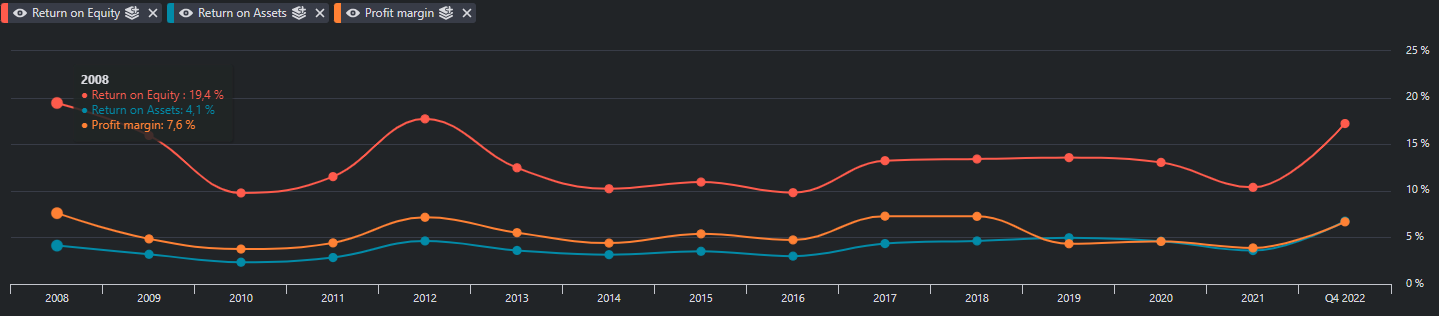

2. ITOCHU’s Return On Equity is high at 17%

The second criterion is high profit margins. I believe that the rate of return is a measure of the strength of competitiveness, and the higher the rate of return, the better.

ITOCHU's rate of return is measured in ROE (return on equity) and ROA (return on total assets). Since 2008, they are as follows (cited by Borsdata):

ITOCHU's ordinary profit margin is in the single digit range, which is low. However, ITOCHU's sales have changed significantly due to changes in accounting policies, so it is difficult to refer to them.

On the other hand, looking at ITOCHU's ROE and ROA, they are 16.9% and 4.8%, respectively. For Japanese stocks, Average ROE is about 8% and ROA is about 4-5%.

In summary, ITOCHU's profit margin seems to be average or slightly higher than their peers.

3. ITOCHU's Cash Flow is Stable

The third criterion is the abundance of cash flow. Cash flow is a numerical value that indicates the inflow and outflow of cash, and is important as an index that reflects the actual state of the business.

* Free cash flow is the difference between operating cash flow and investment cash flow (absolute value).

Also, now when interest rates for loans are ticking up faster than they have for 40 years, having an abundance of cash can truly make or break your balance sheet.

The changes in Free Cash Flow (FCF) of ITOCHU are as follows (cited by Borsdata).

There are years when investment cash flow is high, and there are times when free cash flow is negative.

However, since the negative amount of free cash flow is supplemented by the positive amount of financial cash flow, there is no year in which cash and cash equivalents have decreased.

There is no concern about the cash at hand for ITOCHU, and we can see that it is a company with high business continuity.

4. ITOCHU's Finances are Sound

The fourth criterion is financial soundness.

Looking at the balance sheet, you can see the breakdown of assets and liabilities of a company. The balance sheet shows signs of the company that do not appear in data points like sales and profits.

Sales and profits are important, but I think balance sheet cleanliness is a better indicator of the company’s health.

The balance sheet of ITOCHU is as follows (cited by Borsdata):

On top of total equity outstripping current liabilities by a fair amount, ITOCHU's Net Debt in -54%!

This basically means that ITOCHU currently has 54% more cash than debt and they can pay off all their debt and still have more than half their cash left.

All in all, there is basically no risk that ITOCHU will have issues paying off their debt in the near future, even if interest rates on their loans increases substantially.

5. ITOCHU's Stock Price is at a slight Premium

The fifth criterion is the cheapness of the stock.

The stock price chart of ITOCHU is at 3,751 JPY when this article is released.

*Click here for the latest stock price of ITOCHU Corporation

In this section, I am using the following three as indicators to assess the cheapness of stock.

P/E (Price Earnings Ratio)

P/B (Price Book-Value Ratio)

P/E and P/B are important stock price indexes for understanding the fair value of a company, but they are just indicators and not answers. However, they do give a quantitative number on the stock’ cheapness.

ITOCHU's Price to Earnings Ratio (P/E) is at average 8, which is very cheap

First, looking at the transition of ITOCHU's P/E, it is as follows:

ITOCHU's P/E temporarily increased to 13,4 in Q4 2021, but has continued to decline since then.

It is said that the average value of P/E is about 15 on the Japanese stock market, so the current P/E of ITOCHU is generally cheap.

However, compared to ITOCHU's past P/E of around 8, 8.7 times is a little higher, but definitely low.

ITOCHU's Price to Book ratio (P/B) is about 1.3x, which is cheap for its growth.

Check the graph above to see ITOCHU’s historical P/B ratio.

A P/B at 1x is simply put the value of dissolving the company; the value of the company that remains if the business is liquidated is used as a floor of how low the stock could go.

A rule of thumb is that the stock price is cheap if P/B is less than 1x. However, stocks with good performances are almost always higher than 1x as a premium to their assets should be granted for their growth. Hence, a “fair” P/B may be 10x or more for high quality growth stocks.

As discussed above, ITOCHU has a higher than average growth in the trading company segment. Hence, a P/B of 1.3x compared to its good growth rate and profits is very cheap.

6. ITOCHU has a Relatively High Dividend Yield

The sixth criterion is if the company has a good attitude towards its shareholders.

The main way to assess this is to look at the companies dividends. There are pros and cons to dividends and some people prefer to promote reinvestments or stock buybacks in the company. However, stocks with dividends and have the advantage that the rate of decline in stock prices is relatively small when the market is hit by a shock. Also, dividends are historically much less likely to be removed than stock buybacks.

Let's take a closer look at ITOCHU's dividends:

ITOCHU's dividend yield is relatively high, but going down?

The changes in the dividend yield of ITOCHU are as follows (cited by Investing.com):

Dividend yields have fallen slightly due to stock prices rising since 2016. However, the dividend yield has been about 3% at average.

The average dividend yield of Japanese stocks is around 2%, so ITOCHU is a relatively high-dividend stock.

ITOCHU is increasing dividends over the long term

The dividend yield of ITOCHU has gone down. However, this is due to the stock’s increase in value. The actual dividend amount have increased yearly (source: Borsdata):

The current dividend payout ratio is about 25%, and there is still plenty of room for dividend increases .

* Dividend payout ratio: An index of what percentage of net income after tax was paid as dividends.

This shows that ITOCHU cares for its shareholders and that we can expect further dividend increases if its current business performance continues to be favorable.

Comparison of ITOCHU and its competitors

As competitors of ITOCHU, I compared the performance of Mitsubishi Corporation, Mitsui & Co., and Sumitomo Corporation with various investment indicators.

Due to the recent rally in natural resources, ITOCHU’s competitors have seen a higher increase in their stock prices. If you believe in a further increase in natural resources, they might be a better bet.

Trading company stocks are generally considered to be economically sensitive, so many companies are cheap in terms of Price to Book ratio (P/B).

On the other hand, ITOCHU's P/B is slightly higher than its competitors, giving a sense that its overpriced. However, ITOCHU has the highest Return on Equity and Return on Assets of all its peers, so the higher P/B is justified.

To summarize: ITOCHU outclasses its peers in long-term profitability, but Mitsubishi Corporation, Mitsui & Co., and Sumitomo Corporation are cheaper stocks.

Summary: Is ITOCHU a Stock Worth Buying?

ITOCHU's financial condition and free cash flow is good, and its business performance is showing long-term growth. In addition, The company’s dividends are increasing yearly, and the dividend yield is approximately 3%.

On the other hand, ITOCHU is arguably the most popular trading company stock, so its stock price is expensive compared to its peers. I think this is justified as the company has performed better than its peers historically. However, if the company’s growth cannot be maintained, the price premium may be corrected and the stock price may fall.

All in all, I believe ITOCHU strong historical performance and current investments show that the stock still has room to grow long term. Hence, I believe this stock is the best stock among Japanese trading companies, and a buy on its current price!