Stock markets all around the world are collapsing. The world’s largest index, the S&P 500, is down around 23% year-to-date (YTD). Other indexes, like the Sri Lankan ASPI index have fallen almost 40% YTD and the Irish stock exchange (ISEQ) has fallen 24% YTD.

The main Japanese stock index, the Nikkei 225, looks to have been relatively spared with a fall of of 11% YTD.

In reality, the downturn is much worse. As the Japanese Yen has dropped around 30% to the US Dollar during this time-frame. Acknowledging this, you could rightly assume that the Nikkei 225 has fallen more than its US counterparts.

This means that a lot of you have lost a lot of money. However, it also means that a lot of high-quality stocks are on sale right now!

In other words, it’s time to go fishing in the stock-market abyss:

How I find the most undervalued stocks on the Japanese stock market

To find the absolute top quality stocks on the Japanese stock market that are trading at a discount YTD, I am using three value strategies:

1. My tried and true Value Vetting Strategy

I’ve used this strategy many times in the past to syphon out undervalued companies. Simply put, it aims to find cheap stocks that have a relatively high growth. The criteria are as follows:

A P/E less higher than 6 but lower than 25

An average Earnings Growth higher than 7% over the past 7 years

Return on Equity at at least 10%

A dividend yield higher than 0.5%

Net debt / Earnings Before interest, Taxes and Depreciation lower than 2

ALSO ADDED, a minimum of a -10% in valuation year-to-date (YTD). This is to only find the bargain stocks.

2. The Graham Strategy

As explained here, The Graham strategy is based on 7 specified criteria. A company’s score is ranging from 0 to 7 depending on how many of the criteria a company meets in these areas:

Size - companies too small will have a low survival rate in downturns

Financial Strength

Earnings Stability

Dividend History

Earnings Growth

Moderate P/E ratio

Moderate price for Book Value (BV)

3. The Piotriski F-score

Piotroski’s F-score is named after the Stanford accounting professor Joseph Piotroski and is number between 0 and 9 (9 being the best) which is used to assess the strength of company's financial position.

The score is calculated based on 9 criteria divided into 3 groups. You can read more about how these criteria are calculated here.

Simply put these are the three main groups:

Profitability (ROE, OCF, ROA)

Leverage, Liquidity and Source of Funds

Operating Efficiency

A company gets 1 point for each met criteria. Summing up of all achieved points gives Piotroski’s F-score (a number between 0 and 9).

Please leave a comment if you have any opinion or questions on my filtering strategies:

The 4 Most Undervalued Japanese Stocks Right Now

Only four companies on the Japanese stock market managed to get a full score on all the extremely stringent criteria above (before the recent market downturn, no company got the full score)!

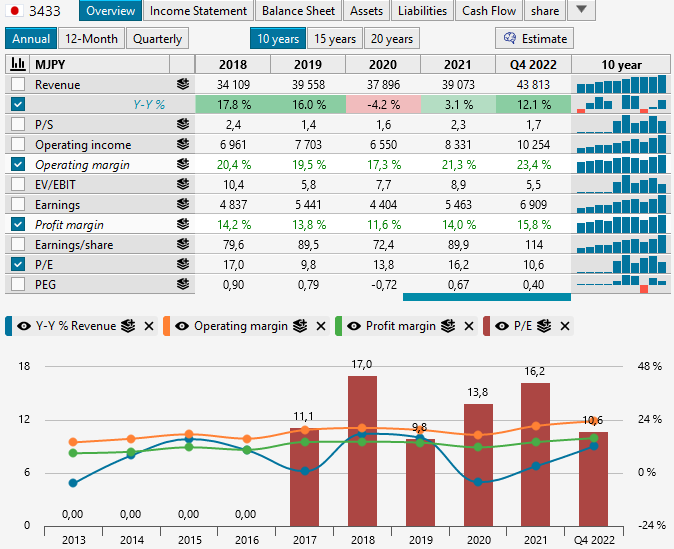

1. Miroku Jyoho Service (-24% YTD)

MIROKU JYOHO SERVICE CO., LTD. has since 1977 targeted a specific market through the company policy of "developing and expanding the finest management systems and know-how for tax accountant and CPA firms and their clients (small/mid-sized companies), while also offering management information services.”

2. Nippon Concept Corp (-23% YTD)

NIPPON CONCEPT CORPORATION is involved in the transportation of liquid cargoes using tank containers, including chemicals, petroleum chemicals, detergent raw materials, ink, fragrances and food materials. The Company mainly provides its services to chemical manufactures and distributors, as well as food companies.

3. Tocalo (-16% YTD)

TOCALO Co., Ltd. mainly develops and provides thermal decomposition (TD) processing, coating processing, plasma transferred arc (PTA) processing, physical vapor deposition (PVD) processing business, with a focus on thermal spray coatings.

The Company operates in two business segments: The Thermal Spray Coatings segment that provides spray processing for semiconductor and parts of flat panel display (FPD) manufacturing equipment, and gas turbines for power generation and batteries for electric power storage. The company also provides various bearings and other parts for industrial machinery, steel rolls and paper-making rolls, as well as chemical plant parts and other equipment parts.

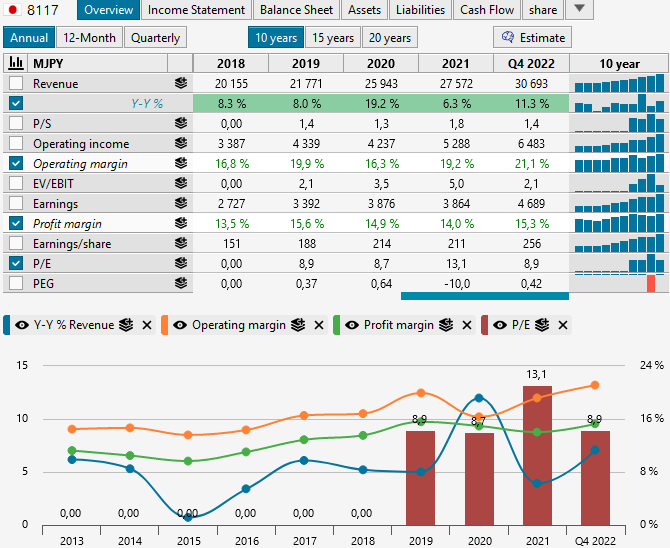

4. Central Automotive Products (-18% YTD)

CENTRAL AUTOMOTIVE PRODUCTS LTD. is mainly engaged in the Automobile-related segment. The Automobile-related segment is involved in the development, sale, import and export of automotive parts, supplies and accessories, as well as the provision of related services. This segment is also engaged in the sale of new and used cars, as well as the warehousing business.

For 10-years of historical data on today’s companies, please download the Excel file here: